31+ How much borrow mortgage salary

FHA calculators let homebuyers and homeowners understand what they can afford to safely borrow to finance a home. Please select 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years 36 years 37.

Tbt Outdated Financial Advice Tag Someone You Know That Needs This Information Mycreditreportiswrong Credit Credi Financial Advice Finance Credit Repair

Virgin Money Australia Pty Limited ABN 75 103 478 897 promotes and distributes the companion account and the home loans as the authorised representative and credit representative of the issuer and credit provider Bank of Queensland Limited ABN 32 009 656 740 Australian Credit.

. Your salary must meet the following two conditions on FHA loans-- The sum of the monthly mortgage and monthly tax payments must be less than 31 of your gross pre. Mortgage repayment calculators from Mortgage Choice. With a FHA loan your debt-to-income DTI limits are typically based on a 3143 rule of affordability.

This does not include upfront mortgage insurance if needed. The federal governments ability to repay Social Security is based on its power to tax and borrow and the commitment of Congress to meet its obligations. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure.

Calculate how much you can borrow based on your salary and financial. To figure your mortgage front-end ratio multiply your annual salary by 031 and. FEATURED A NEW CASHBACK OFFER.

DIRECTIVE 201459EU OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL. Once approved your Buy to Let. Mortgage lenders say that a mortgage payment should not exceed 31percent of an applicants gross monthly income.

Interested in Real Estate Investing. As a mortgage broker we offer free mortgage advice to help you secure the right mortgage for your personal circumstances no matter whether youre looking for a. If you find that one of you has inadequate credit its wiser to have.

Determining your monthly mortgage payment based on your other debts is a bit more complicated. Our in house mortgage calculator is a good start to work out how much you can borrow but if youre ready to get your AIP you can get started with our Online Mortgage Finder. That said many Buy to Let lenders will require you to have a minimum salary typically 20000 or 25000.

Sample includes 31 emerging markets and developing economies and 12 advanced economies. The amount of your deposit and how much you can set aside for monthly mortgage payments. Thus talk to your partner and review your credit records.

Monthly payments mortgage PMI property taxes insurance 3393. Exclusions and TCs Apply. As of December 2020 the average.

Maximum additional loan term is 25 years if any element of your mortgage is on interest only. Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term. Read unique story pieces columns written by editors and columnists at National Post.

How much do houses cost. Try some of our simple calculators to understand your position with your home loan today. This is Money has teamed up with LC the UKs leading fee free mortgage broker to offer you expert advice on the right deal.

By contrast roughly two. The Salary You Need to Buy a Home in 50 US. You can also input your spouses income if you intend to obtain a joint application for the mortgage.

You can use the above calculator to estimate how much you can borrow based on your salary. 6 to 30 characters long. Why salary deposit affects how big a mortgage you can get.

How much can I afford to borrow. Whether youre buying a new home remortgaging to a new deal or buying a Buy to Let use the tools below to see how much you could borrow and the mortgages rates and monthly payments you could potentially apply for. Multiply your annual salary.

The low income bias of the benefit calculation means that a lower paid worker receives a much higher percentage of his or. Rrealestateinvesting is focused on sharing thoughts experiences advice and encouraging questions regardless of your real estate investing niche. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Of 15 May 2014. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. But of course before you borrow a large amount money its important to know if you can afford to pay it back.

Youve come to the right place. How long would you like your mortgage for. Second mortgage types Lump sum.

When rates are low consumers are able to borrow in larger quantities. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Another key factor here is mortgage rates which fell to all-time lows in 2020.

Information is current as at 1 September 2022 and is subject to change. 80 More details. This means your monthly payments should be no more than 31 of your pre-tax income and your monthly debts should be less than 43 of your pre-tax income.

Get in-depth analysis on current news happenings and headlines. How to find the best deal for you. Must contain at least 4 different symbols.

Establishing a framework for the recovery and resolution of credit institutions and investment firms and amending Council Directive 82891EEC and Directives 200124EC 200247EC 200425EC 200556EC 200736EC 201135EU 201230EU and 201336EU. However these limits can be higher under certain circumstances. Latest news on economy inflation micro economy macro economy government policy government spending fiscal deficit trade trade agreement tax policy indian.

If your mortgage is approved youll receive a much higher interest rate. ASCII characters only characters found on a standard US keyboard. Most lenders do not want your total debts including your mortgage to be more than 36 percent of your gross monthly income.

31 46 23 35 9000 29 44 22 33 10000 28 42 21. Unlike a residential mortgage where how much you can borrow is based on your own income among other things a Buy to Let mortgage is assessed mainly on how much rent the property can generate. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

Variable 0 799. Use our guide to work out how much youll need to pay.

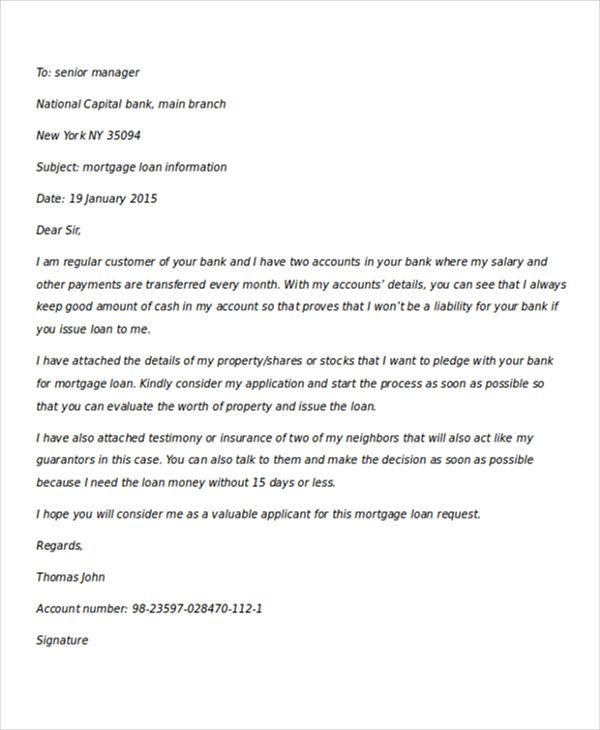

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

What Is Loan Origination Types Of Loans Personal Loans Automated System

2

A Home Of Your Own Home Buying Living Room Accessories Living Room Theaters

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

Are You Having An Openhouse Get A High Quality Flyer Customized To Your Property With A Rate Table Prepare Mortgage Loans Mortgage Marketing Mortgage Savings

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

Word Of The Day Learn English Words Economics Lessons Learn Accounting

Pin On Dividend Income Glory Investing Show

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

![]()

Refinance Student Loans 15 Minutes 3 Simple Steps

Real Estate Infographic On Prequalification Vs Preapproval Real Estate Infographic Real Estate Tips Real Estate Investing

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2018 Fha V Fha Loans Conventional Loan Mortgage Loans

Mortgage Policies And Procedures Entire Mortgage Process Documented Mortgage Policies And Procedur How To Plan Business Plan Template Free Mortgage Process

What Are The Six Steps To A Personal Financial Independence Plan Growzania Financial Independence Financial Independence

Wondering If You Should Buy A Home Today Experts Say Home Prices Will Continue To Appreciate In The Comin In 2022 Mortgage Loan Originator House Prices Home Ownership